is there a tax on death

The Estate Tax is a tax on your right to transfer property at your death. No your life insurance policys death benefit is not subject to taxes.

5 Excuses People Give For Not Buying Life Insurance Group Life Insurance Life Insurance Insurance

While that money can be used in ways that trigger a taxable event the payout itself is not taxable.

. The good news is that theres no inheritance tax at the federal level and only some states impose one. Lets get straight to the point. After all dead people arent getting any more services from government.

The estate tax. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF. Federal capital gains possible state capital gains and federal estate.

Since only half the gain is taxable tax would be owing on a 300000 taxable gain. The death benefit is not taxable only the interest on installments If the beneficiary is an estate If the policyholder names an estate as the beneficiary in a life insurance policy the process. Since the transfer on death deed doesnt give away your property while youre alive it may not be subjected to gift tax but this depends on your state.

For estates that are under 11 dollars your assets must equal approximately 1 for your death. This means that there would be effectively two or even three death taxes. A few states also levy estate taxes as well so you could get.

All the assets of a deceased person that are worth 1170 million or more as of 2021 are subject to federal estate taxes. Life Insurance Death Benefits Are NOT Taxable. Assuming a 45 marginal tax rate for the year of death 135000 of taxes would be payable on the terminal return as a result of this deemed disposition.

Even if the property you pass using a transfer on death deed isnt counted toward probate it may still be included in the valuation of your estate and thus count towards any applicable estate tax. Although there is no death tax in Canada there are two main types of tax that are collected after someone dies. However tax may be due on any interest earned by the death benefit.

This article explains what qualifications are necessary to receive death benefits how ADBs differ from long-term care policies and what to expect when accelerated death benefits are paid out. Also called death tax is a one-time government-imposed tax imposed on estates after death. Death taxes are taxes imposed by the federal andor state government on someones estate upon their death.

In just about all cases the death benefits paid by insurance policies are free from income tax. This situation occurs when the payout of death benefits is delayed. But one tax that comes about as close as possible to being theft is the estate tax.

While estate taxes seem to get all the publicity when it comes to taxes owed after someone dies the reality is that the majority of estates will not owe any federal estate taxes. Second there is interest or capital gains made on money in the estate. That amount increases to 1206 million for the 2022 tax year.

This includes both the Federal estate tax and state inheritance taxes. The death tax is any tax levied on property and assets being transferred from the estate of a deceased person. Lump Sum Death Benefit Taken In Monthly Installments Beneficiary Annuity The monthly payments are subject to federal income tax but not that portion attributable to the deceaseds previously taxed IMRF member contributions Members who participate in the Regular Plan contribute 450 of salary toward a future IMRF pension.

Transfer on death tax implications run from capital gains on stocks to estate taxes in the case of large sums to inheritance taxes if the. The heirs would increase the basis by the gains ie their basis would be market value at time of death the same as under present law. A federal estate tax return and a tax lien are attached to estates in 2026 taxable at 5 million when the exemption is restored.

The capital gain on the deemed disposition at death would be 600000. The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them. 375 for the member and 075 for.

For the 2021 tax year the federal estate tax exemption is 1170 million and In the 2022 tax year its 1206 million. Accelerated death benefits ADBs are tax-free advances on your life insurance death benefit while you are still alive. First there are taxes on income or on capital gains earned during the last year of life.

Interest accrues on the funds during the delay and that interest is taxable when the funds are eventually paid out. The estate tax is as the IRS puts it a tax on your right to transfer property at your death All the cash and property you own at. Sometimes known as death duties.

One of the biggest benefits of life insurance coverage is that any payout your loved ones get following your death is provided to. The laws of the state where the account owner lived at the time of their death would dictate whether their heirs would be required to pay inheritance tax on the account. Inheritance Tax IHT is paid when a persons estate is worth more than 325000 when they die - exemptions passing on property.

Death is to treat death as a realization event that is treated as if the decedent had sold the asset in the last year of life and tax capital gains at that time. Not all taxation is theft.

Dime Method For Insurance Stock Advisor First Love Insurance

Tax Funny Income Tax Tax Memes Taxes Humor

Thruth Be Told True Life Everything Funny Humor

Risks Of Adding Your Child To Your Home S Deed In 2021 Home Equity Line Revocable Trust Death Tax

Paying Too Much Inheritance Tax Inheritance Tax Death Tax Inheritance

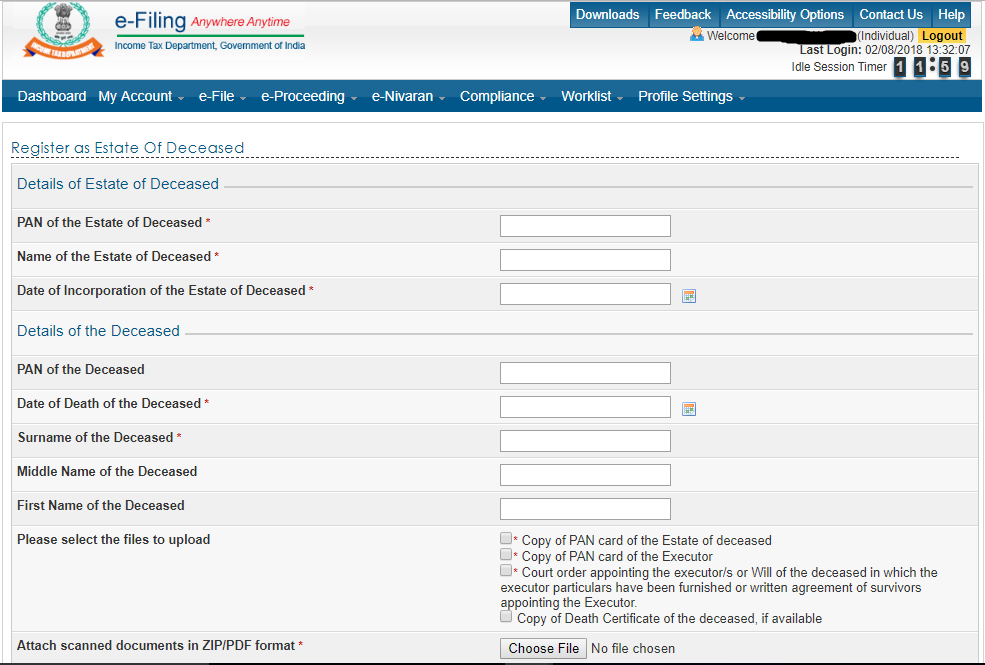

How To File Income Tax Return For The Deceased By Legal Heir

Is Life Insurance Taxable Tax Season Income Tax Best Tax Software

What Is The Death Tax And How Does It Work Smartasset

Its Tax Times Some Funny Tax Quotes That Will Tickle You Tax Quote Funny Dating Quotes Taxes Humor

The House And Senate Tax Bills Would Both Be Good For Real Estate Investors Realestate Realestatelife Taxes Tax Capital Gains Tax Business Tax Tax Services

Gladstone Morgan Limited Company Tax Planning And Trust Gladstone Morgan Limited How To Plan Gladstone Trust

Legacy Assurance Plan Pointing About The Federal Estate Tax And How This Tax May Affect Larger Estate Planning Estate Planning Checklist Revocable Living Trust

The Geography Of Taxation Infographic Infographic Study Fun Geography

After The Recent Removal Of Death Tax In The Tax Reform It Becomes Clear That The Estate Whole Life Insurance Business Interruption Insurance Health Insurance

/close-up-of-female-accountant-or-banker-making-calculations--savings--finances-and-economy-concept-1006671124-6a117470967b4b49960be0fb69f474a4.jpg)